We all know the power of a strong brand. How effective and important is it for a business to be top of mind to potential customers. How successful brands manage to position themselves in a specific industry or market. If I had to ask anyone to name 3 tech brands, they would easily mention brands such as Amazon, Google, Microsoft or Apple. Their strength certainly locks their prominence in each of their respective markets. Very few businesses are able to achieve this status.

Data shows that there is an increrasing majority of people who resource to top of mind brands rather than online searches to choose a product or service provider online.

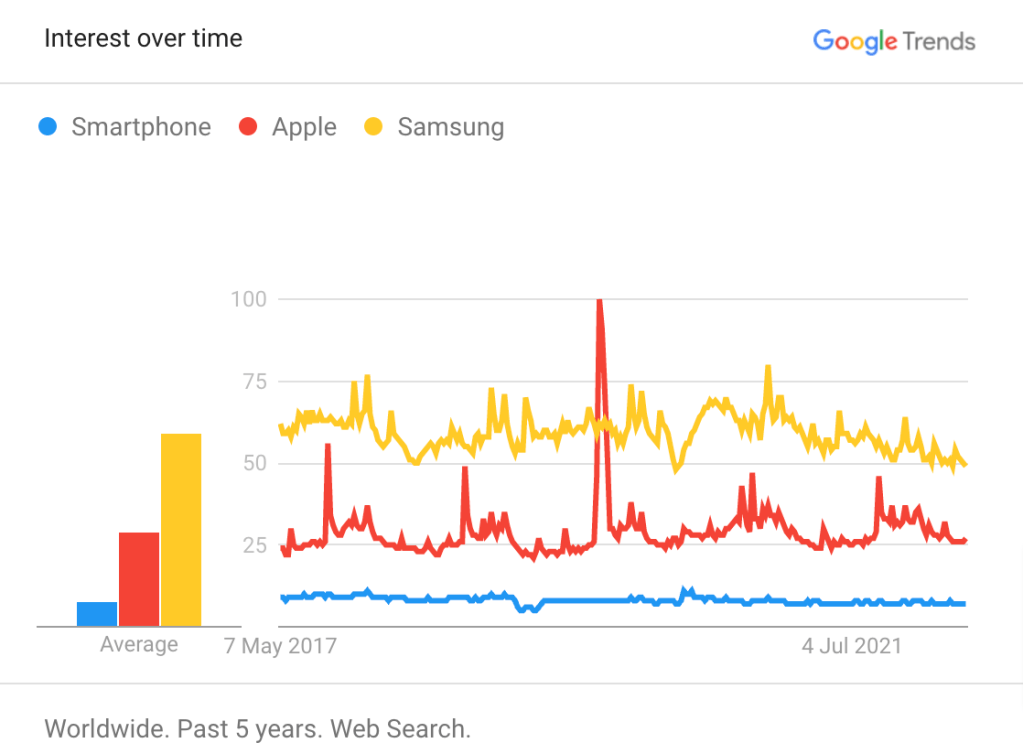

Google Trends

Most businesses have not achieved this status, but have invested in brand development in some way; they either have a logo and brand identity, have prepared some collateral such as leaflets, have a website or run ads online. The biggest issue is understanding how to accelerate business growth through brand advertising.

Are you looking to justify brand-building investment and are struggling to demonstrate to investors or senior leadership the importance of brand development?

If this is the case, continue reading to learn what are the steps you need to take to untap your brand growth potential:

- Are you ready to invest in brand building?

- What data and insights do you need to build a case to secure the investment to develop a brand?

- What are the best practices when planning a brand campaign?

- How will you measure the effectiveness of a brand campaign?

It is certainly a great opportunity for any business that creates a new product category or service to position itself as the brand of reference. It can be a matter of time until someone else will do this. Why hold you FOMO? Take action!

Are you ready to invest in brand building?

Before you get started, it is very important to notice the requirements a business should check before jumping into brand development through advertising. (You can read below or skip straight to the next section if you’re not interested in this)

- Has the business/product proven a market fit?

- Has the business exhausted the lowest hanging fruits in direct response media investment? This means you’re already investing in channels such as paid search, tested display and paid social channels for lead gen or e-commerce, have set up affiliate marketing, and have a decent or successful referral program. At times PR is a way to grow a brand done right, this can be very cost-effective.

- Are the means to develop the brand aligned with the potential market opportunity? (Don’t try to kill a fly with a bazooka).

- Is your industry or market growing or with prospects to do so?

- Has the business developed the culture/buy-in from senior leaders to realise the importance of brand building?

- Have you covered the foundations of a brand? Do you have a proper brand identity and stylebook?

If you can say yes to all the above questions, you are in a great position to start thinking in developing a business case to invest in brand building.

Talking about brand building is challenging. This is such a broad topic, so many factors will influence this: The quality of your product, the reputation of your service (eg: Trustpilot scores), you have a good customer service, and your product is not competing only with price. You have a decent Public relations team that works with different media publishers.

All the above would contribute and help you build a brand organically. But if you have the ambition and resources to fuel the growth of your business through paid advertising, you can start looking at taking the first steps to develop your brand in a much faster and more impactful way.

What data points should you be looking at to develop the media strategy?

If you’re in a situation where the business has not invested in a brand yet but are looking to identify the data points that would justify it. You might be wondering what accessible data I can use to prove its value to the business.

Use any of the following examples:

- Google search trends for brands

Search trends can help you illustrate how well recognised is your brand against other competitors or brands over the last couple of years.

The above example is from 3 financial services and technology brands I have used recently. This helps illustrate the behaviour of users over time and how your stack over competitors.

- Compare the cost and volume of your paid search brand traffic

If you are already running paid search ads through Google, you will identify that your brand campaigns are the best performing campaigns in terms of cost per acquisition and conversion rate. Your branded and direct traffic is the most valuable. Use this data to prove the value of this.

Below you can see a table that illustrates the volume, CR and CAC you can expect from your website while you are at the early stages of development.

| Campaign type | Volume | CR | CAC |

| Brand | Low | High | Low |

| Generics | High | Low | High |

| Product-specific | Mid | Mid | Mid |

| Competitors | – | Low | High |

As your brand matures and your business becomes more relevant, your brand traffic will increase.

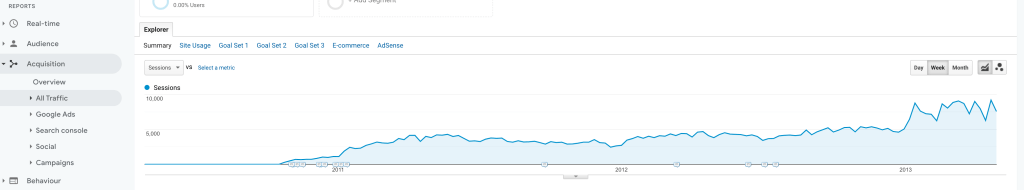

- Use historical data from your website

If you’ve been in business for a couple of years, there is a specific report you can look at that will illustrate how your brand has been growing with your business. This is especially relevant if you are a retailer or you are servicing SMBs. If your business is too niche, this might be hard to perceive.

You should be looking at the brand and direct traffic reports: Use Google analytics or any of your website tracking tools and pull a report that displays these two metrics, make sure that you look back over the last couple of years.

Like many marketers, if you keep track of the impact of the initiatives you’re driving, you should be able to spot the times your marketing has pushed this traffic higher.

- Google search industry insights

If you are already spending a significant budget on paid advertising through Google, you will obtain support from their account managers. Their job is to assure you have the support required to make the most out of Google advertising products (And spend as much as possible too). But what they also provide (usually on a quarterly basis) are industry insights through a personalised report.

This report includes some interesting metrics about how you stand Vs other competitors. The metric I find more interesting is “Industry Search Share”. This metric aggregates all industry generics and brand searches happening in a market and tells what percentage of those searches you own. As I like to think, this can be used as a proxy for “digital market share”. If your brand is not well recognised, you will quickly see low brand search share.

With the above examples data points and some time to educate the business, you should be able to understand where you are Vs your competition and start thinking on securing some budget for brand development.

Best practices when planning to run a brand advertising campaign

You’ve run an analysis and you know you should be investing in brand building but you have not done this before. There are certain things you should keep in mind when setting this up and a change in the paradigm on how we approach growth:

- From short term to long term

- If your focus has been to look at revenue targets on a quarterly basis. You should start thinking about changing this approach. Positioning a brand and being able to see the impact of brand-building campaigns generally will take a little bit longer (6 months minimum).

- From rational to emotional

- You will need to change your approach to communication and creative messaging. Shifting from rational messages based on the product features to more emotional messages focused on building a connection with your audience.

- From In-market audiences and direct response to demand generation

- Move from being focused on using all the available resources to connecting with in-market audiences and direct response campaigns. To generate the demand through advertising.

- From specific events to whole journeys

- Move from measuring one specific event and giving all the credit to the last channel that drove the customer to understand the whole journey and using multitouch-multichannel attribution reporting and adjusting the window you use to assess the interactions you have with prospects and customers.

- Continue to Test and learn everything

- Continue to test everything that you do, formulating hypotheses to test creatives, channels, ad formats or audiences

Additionally, you will have to set a content/messaging plan and a media plan focused based on the research you have developed around customer personas.

How will you measure the effectiveness of a brand campaign?

When developing a media plan focused on generating brand awareness, you’ll be looking at using channels that can deliver high impact creative and can generate volume and increase reach while ensuring accurate targeting. These channels tend to be programmatic display and video through any platforms such as Google, Facebook, LinkedIn, Tiktok, Youtube, and any other platform or exchange that accepts display and video advertising.

The media agency will often access a DSP (Demand-side Platform) to plan and execute the media buying. Planning of the campaign will be focused on delivering reach and frequency buying at a CPM (Cost per thousand impressions).

- Performance delivery metrics

You will need to develop a measurement framework that is relevant to the objectives you have set. As I had shared in a previous post, a basic measurement framework can look at volume, quality and cost.

Reach (volume) and frequency (quality) can be your main measures of delivery against the budget (cost) to generate awareness. This is usually focused on generating the optimal number of impressions recommended. There are some studies that prove that the optimal rate to achieve the objective and maximise the budget is between 5 and 7 impressions per user.

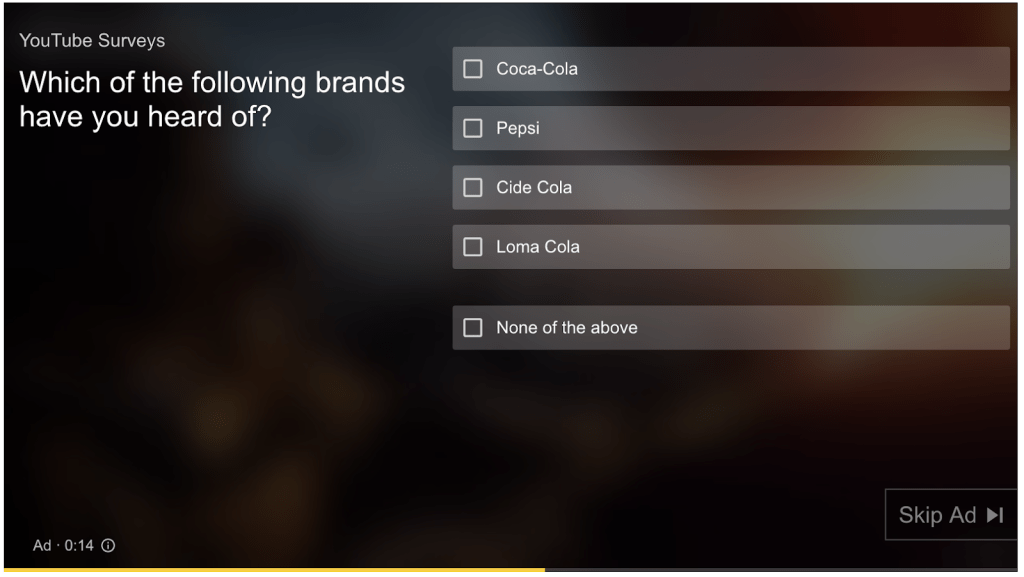

- Measuring awareness and consideration

On the other side, you’ll be trying to understand how the campaign is influencing prospects. Is it generating awareness and preference? Most businesses will work with agencies that pick a panel of users with specific demographics and run a survey to assess how well recognised the brand is and if they would consider it. You can also understand how effective the message is and with what they associate the brand. For a brand campaign, it is a good practice to run this survey using the pre-post method. Using the same questions and measuring what has changed before and after the campaign. Helping you understand how effective the campaign is.

There is an advantage on running the survey in advance as you will also be able to identify the media consumption habits of your target audience, understand how they perceive the competition, what is their decision making process / what influences their decision in picking a provider or switching to a new provider, how they perceive your brand.

There are plenty of insights you can gather from this survey.

- Measuring awareness and consideration mid-flight

At the age of data I find it very risky to let run a campaign for 4 to 6 months with no changes or feedback. For this reason one of my favourite ways to measure the effectiveness of the brand campaign mid flight is using YouTube brand lift and search lift programmes. These are specific tools designed by Google that are very helful at measuring the effectiveness of the campaign mid-flight in a short period of time (no extra cost).

You’ve probably stumbled upon surveys like the below while watching YouTube videos.

If you have, you’ve been part of a panel to test and identify a brand campaign’s effectiveness through YouTube. This is usually running as a control/test (a/b) to identify what is the brand lift of the YouTube campaign.

- Impact on industry searches and brand search share

Additionally and in parallel you can also use the Search lift program, which will provide insights into the impact of the brand campaign on target audience search behaviour. It will even go to the detail on telling you how your campaign is influencing industry generic searches or the changes in search volume of your brand.

You can use all the above insights to optimise, test and maneuver while the campaign is still running.

- Measuring the impact of a brand campaign on revenue

This is one of the most crucial questions to answer. What is the ROI of the campaign? You should start looking at this through multitouch multichannel attribution reporting to ensure you have visibility on the journey and interactions your prospects had in their decision-making journey. You can read more about attribution and reporting best practices here.

But don’t forget that brand building is focused on positioning brands, changing perceptions and building preferences and very rarely you’ll be able to prove a positive ROI in the short term. But if you stay consistent have a competitive product and have taken care of developing a solid plan you should start seeing green shoots from the first couple of months.

With all these guidelines and tools, you should be ready to strategize, plan, activate, and measure your brand campaigns through digital channels like a pro.

Do you have any questions, are you using a different method, you think there is a better way to approach this topic? Please share in the comments below!